Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Property liens are legal claims or encumbrances placed on a property by a creditor to secure payment of a debt. The lienholder has the right to take possession of the property if the debt is not paid. Property liens can be placed on real property, such as land and homes, as well as personal property, such as automobiles and boats.

What is the purpose of property liens?

Property liens are legal claims that creditors can place on a borrower’s property as a way to secure repayment of a debt. If the debt is not repaid, the creditor can seize the property and use it to satisfy the debt. Property liens can be used for a variety of different purposes, such as to secure payment of taxes, mortgages, and other debts.

What is the penalty for the late filing of property liens?

The penalty for late filing of property liens varies by state. In some states, the penalty is a fine or a jail sentence. In other states, the penalty may be a civil lawsuit.

Who is required to file property liens?

A property lien is typically filed by someone who is owed money and wants to ensure that they have a legal claim over a property until the debt or obligation is discharged. The person or entity who can file a property lien can vary depending on the jurisdiction and the nature of the debt. Some common examples of entities that may file property liens include:

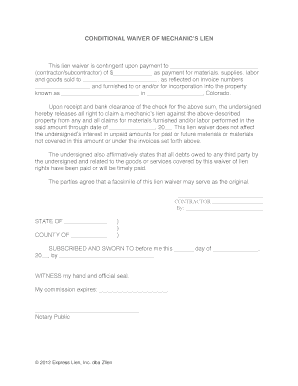

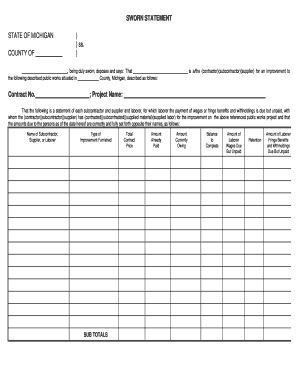

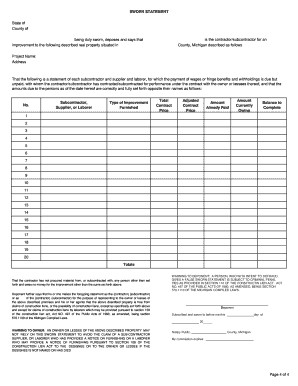

- Contractors and subcontractors: When a contractor or subcontractor is not paid for work performed on a property, they may file a mechanics lien to secure their claim against the property.

- Material suppliers: Suppliers of materials to a construction project may also file a mechanics lien if they are not paid for the goods they provided.

- Homeowners' associations: If a homeowner fails to pay their association fees or assessments, the homeowners' association may file a lien against the property.

- Tax authorities: Governments, such as local municipalities or the Internal Revenue Service (IRS), may file tax liens against a property if the property owner has unpaid taxes.

- Mortgage lenders: Mortgage lenders typically place a lien on a property when they provide a loan to the property owner to secure their interest in the property until the mortgage is repaid.

- Judgment creditors: Creditors who have obtained a court judgment against a debtor may file a judgment lien against the debtor's property to ensure they can collect the debt.

It's important to note that the specific requirements and procedures for filing property liens may vary depending on the jurisdiction and the type of lien being filed. It is recommended to consult with local laws and regulations or seek legal advice to fully understand the process and requirements for filing a property lien.

How to fill out property liens?

Filling out property liens involves a series of steps that may vary depending on your jurisdiction. Here is a general guide:

1. Obtain the necessary forms: Contact your local county clerk's office or the appropriate government agency to obtain the specific lien forms required in your area. These forms may include a lien claim or release form.

2. Provide property information: Fill in the required information about the property, such as the address, legal description, and parcel or lot number. This information is usually available on the property title or deed.

3. Identify parties involved: Indicate the names and addresses of the parties involved in the lien. This typically includes the lienholder (such as a contractor, supplier, or service provider who is owed money), the property owner (debtor), and any other relevant parties.

4. State lien amount: Clearly state the amount owed as part of the lien. Provide detailed information on the services rendered, materials provided, or any other reason for the lien amount.

5. Attach supporting documentation: Attach any evidence supporting the lien claim. This may include invoices, work orders, contracts, or receipts.

6. Notarization: In some cases, the lien form may need to be notarized. This involves signing the lien document in the presence of a notary public who will verify your identity.

7. File the lien: Once the form is complete, follow the instructions provided by your local jurisdiction to file the lien. This may involve submitting the lien form to the county clerk's office, recorder's office, or other relevant government agency. Pay any required filing fees if applicable.

8. Provide notice: In many cases, you will also need to provide notice to the property owner about the filed lien. This notice may need to be sent by certified mail or delivered personally. Strict timelines and specific procedures may apply, so be sure to check the legal requirements in your jurisdiction.

Remember that property lien procedures can be complex, and it is advisable to consult with a legal professional or seek expert advice to ensure compliance with your specific jurisdiction's laws and regulations.

What information must be reported on property liens?

When reporting a property lien, the following information typically needs to be included:

1. Property details: The full legal description of the property including street address, parcel number or tax identification number, and any other relevant details needed to identify the property.

2. Creditor details: The complete information of the creditor or lienholder such as their name, address, contact information, and any other identifying details.

3. Debtor details: The complete information of the debtor or property owner against whom the lien is being placed, including their name, address, contact information, and any other relevant identifying details.

4. Lien amount: The specific amount owed or claimed by the creditor, including any interest, penalties, or additional fees associated with the debt.

5. Lien type: Specify the type of lien being filed, whether it is a mortgage lien, mechanic's lien, tax lien, judgment lien, or any other specific type recognized by the jurisdiction.

6. Filing date: The date on which the lien is officially filed, which is crucial for determining priority when multiple liens are involved.

7. Recording information: Provide details about the office or agency where the lien is being recorded, including its name, address, contact information, and any specific requirements for filing or recording the lien.

It is important to note that the exact information required may vary depending on the jurisdiction and the specific laws governing property liens in that area. Consulting with a legal professional or conducting thorough research on local regulations is advised before reporting a property lien.

How can I get property liens?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific full unconditional waiver michigan pdf form and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I create an electronic signature for signing my unconditional lien waiver in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your full unconditional waiver and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I fill out deed property title on an Android device?

Use the pdfFiller mobile app to complete your unconditional waiver form on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.